When buying a property, whether it be your first home or an investment to add to the portfolio, there are a number of extra hidden costs to be aware of that make the process of purchasing a lot more expensive than initially thought.

Upfront and hidden costs can add as much as $40,000 to the purchase price of a property so it is vital that you factor them into your budget and understand them. Majority of these costs depend on the value of the property being purchased and its location.

Transfer Duty

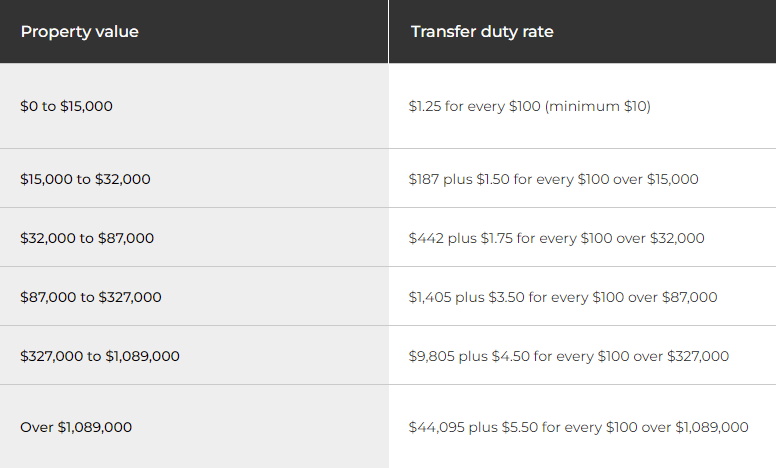

Stamp duty is a tax levied by the NSW Government. It is based on the value of your property and can be significant. Calculate how much your transfer duty will be.

Standard Transfer Duty Calculations from 1 July 2022

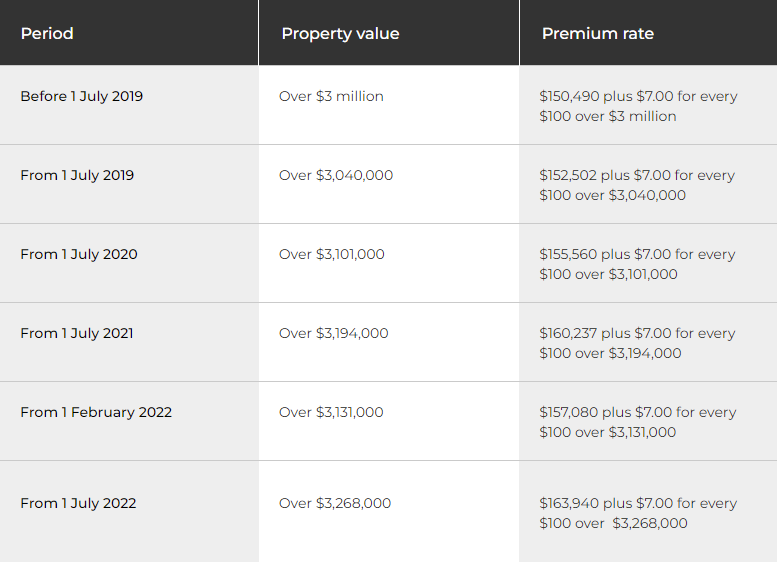

Premium Transfer Duty Calculation (residential properties over $3 million)

Lenders Mortgage Insurance (LMI)

If you are borrowing more than 80% of your home’s purchase price, then you will be required to pay LMI.

For example: If you want to buy a property that is worth $500,000, you would typically require a deposit of $100,000 (20% of the property’s value). If you have saved $50,000 and you have sufficient income to support the loan, you may be able to take advantage of Lenders Mortgage Insurance.

The amount of LMI you are required to pay will depend on the amount that you are borrowing but if you are factoring it into your budget consider saving between $5,000 – $10,000

Pest, Building & Strata Reports

A building inspection is an assessment of a property’s condition done by a qualified inspector, usually before putting in an offer on a property, although an offer can be made conditional on one.

It covers everything from faulty roofs to rising damp and cracked walls, and generally includes information on whether these faults can be repaired and how much repairs would cost. Generally they are $300 to $600 depending on the company and area.

Legal or Conveyancing Fees

Conveyancing involves the preparation, execution, and lodgement of various legal documents to enable a swift and legal sale. On average, conveyancing and legal fees come in at about $1,500 which cover the preparation of sale contract, the exchange of contracts and the completion.

Mortgage Registration Fee & Registration of Title

Mortgage registration and transfers fees are the costs associated with formally registering a mortgage and transferring the property ownership. The costs differ between states however in NSW it’s a good rule of thumb to put away around $300 combined for both of these.

Loan Application Fees & Independent Valuers Fees

Along with the fee for your loan application, you will generally need to pay around $300 – $500 for an independent valuer to value the property you are wanting to buy.

Ongoing costs

Once you have secured your property, there are a few costs that you will have to take into consideration.

Council Rates & Strata levies

You will have to pay council rates. These are generally dependent on a land valuation that are performed annually by the state government. These are usually paid quarterly. Similarly you will have to pay strata levies if applicable (usually if you have bought a townhouse or unit). This is when you have a body corporation that looks after the property. The cost will usually be split into the admin cost and the sinking fee.

Utilities

When you move into a new property you will have to get most of the utilities reconnected. With water charges there is a crossover and the seller is generally required to pay for all the water used up to the settlement date.

Insurance

Insurance – both home and contents – are other immediate and ongoing costs after buying a home.

Insurance is an immediate ongoing cost after buying a home that protect against a wide range of events such as fire, storm and flood damage.

A great tip is to check with your strata if you purchased a townhouse or unit as they usually cover the cost of building insurance in the Body Corp payments.

Building insurance usually covers a main dwelling, a garage and items that are permanently attached or fixed to a home such as light fixtures and built-in wardrobes.

Contents insurance covers items inside a home that aren’t permanently fixed to the walls or floor, like furniture, TVs and fridges.

These costs will affect the money you have available to make your mortgage repayments and pay for everyday expenses.

It’s worth adding all of these costs into your budget so you can calculate how much you’ll need to save to buy and manage a home.

If you were after some more information about reducing these upfront costs if you’re a first home buyer, check out our blogs on the First Home Super Saver Scheme or some more hot tips on how to buy that house!